Tax Rates

Property Tax Revenue for Fiscal Year Ending September 30, 2024

This budget will raise more revenue from total property taxes than last year's budget by an amount of $1,748,437 (15.3% increase). The property tax revenue to be raised from new property added to the tax roll this year is $953,097.

Property Tax Rates

2023 Tax Year

| Organization | Rate per $100 Valuation |

|---|---|

| City of Denison | 0.652034 |

| Denison Independent School District | 1.162500 |

| Grayson County | 0.305100 |

| Grayson College | 0.145991 |

| Total combined rate | 2.265625 |

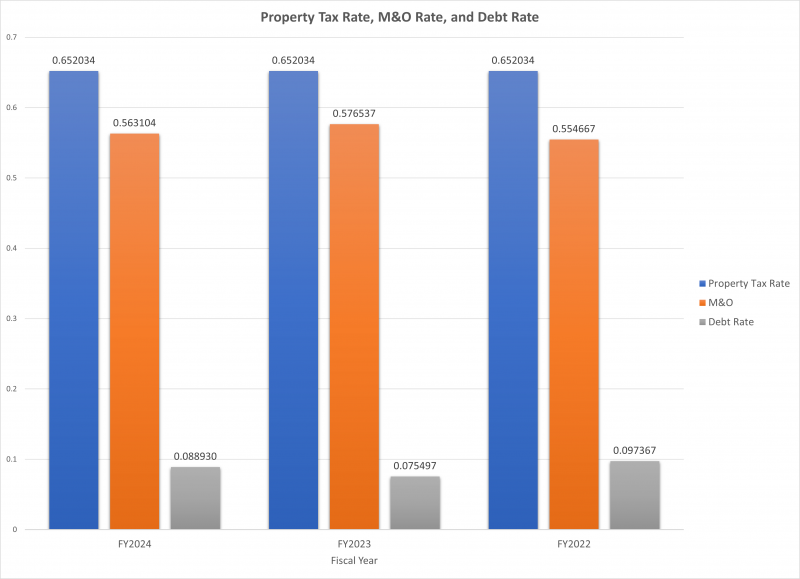

Amount of Property Tax Revenue budgeted for Maintenance & Operations for the current year and previous two years

|

FY2024 |

FY2023 |

FY2022 |

|

$16,249,822 |

$14,128,764 |

$11,003,335 |

Tax & Valuations

- Property Tax is billed and collected by the Grayson County Tax Assessor-Collector. The main office is located at 100 W. Houston in Sherman, 903-892-8297. The Denison Office is located at the County Sub-Courthouse located at 101 W. Woodard in Denison, 903-465-2101.

- Property valuations are performed by the Grayson County Appraisal District, located at 205 N Travis Street in Sherman, 903-893-9673.

Sales Tax Rates

- Sales tax rate - 8.25%

| Sales Tax Rate Breakdown | |

|---|---|

| State | 6.25% |

| City | 1.5% |

| 4A (Economic Development) | 0.50% |

| Total Sales Tax Rate | 8.25% |

Lodging Tax Rates

- Hotel / motel tax rate - 7%